All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash value of an IUL are usually tax-free up to the amount of costs paid. Any type of withdrawals over this quantity might undergo tax obligations relying on policy framework. Traditional 401(k) payments are made with pre-tax dollars, decreasing taxable income in the year of the contribution. Roth 401(k) contributions (a plan function readily available in many 401(k) strategies) are made with after-tax payments and afterwards can be accessed (incomes and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at the very least 5 years and the individual mores than 59. Assets withdrawn from a traditional or Roth 401(k) before age 59 may incur a 10% charge. Not exactly The claims that IULs can be your own bank are an oversimplification and can be misinforming for many reasons.

Nevertheless, you may go through updating linked health and wellness questions that can impact your continuous expenses. With a 401(k), the cash is constantly yours, including vested company matching regardless of whether you stop adding. Threat and Warranties: First and leading, IUL policies, and the cash money worth, are not FDIC guaranteed like typical savings account.

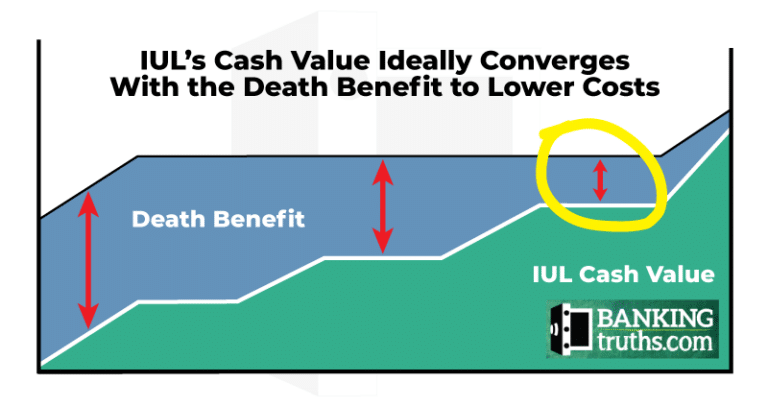

While there is commonly a floor to avoid losses, the development potential is covered (implying you might not completely take advantage of market increases). A lot of experts will agree that these are not comparable items. If you want survivor benefit for your survivor and are concerned your retired life financial savings will not suffice, after that you might intend to think about an IUL or other life insurance policy product.

Certain, the IUL can give access to a money account, but once again this is not the main purpose of the item. Whether you want or need an IUL is a very private inquiry and depends on your primary financial goal and objectives. Below we will certainly try to cover advantages and restrictions for an IUL and a 401(k), so you can further mark these products and make a much more informed choice pertaining to the ideal means to take care of retired life and taking treatment of your liked ones after fatality.

Universal Index Life Insurance Policy

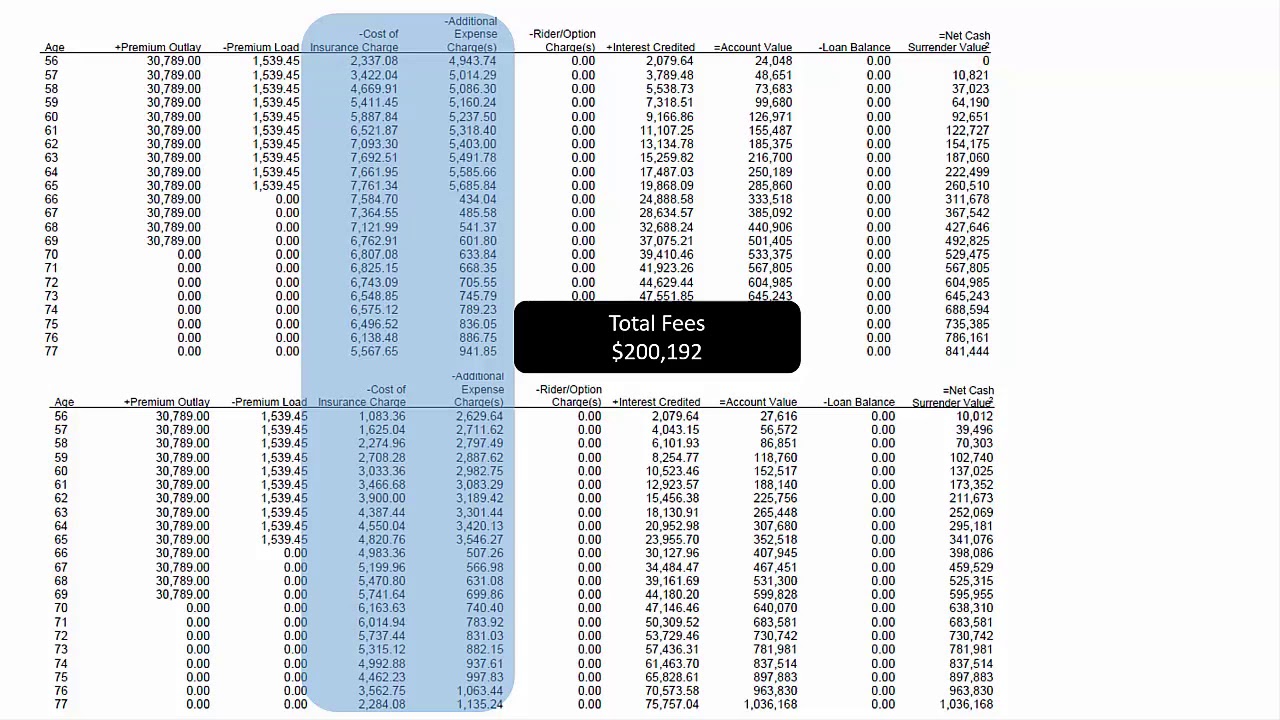

Funding Expenses: Financings against the plan accrue passion and, if not paid back, lower the survivor benefit that is paid to the recipient. Market Involvement Limitations: For most plans, financial investment growth is tied to a stock market index, however gains are generally capped, restricting upside potential - indexed universal life insurance companies. Sales Practices: These policies are typically marketed by insurance representatives who may highlight advantages without fully describing expenses and dangers

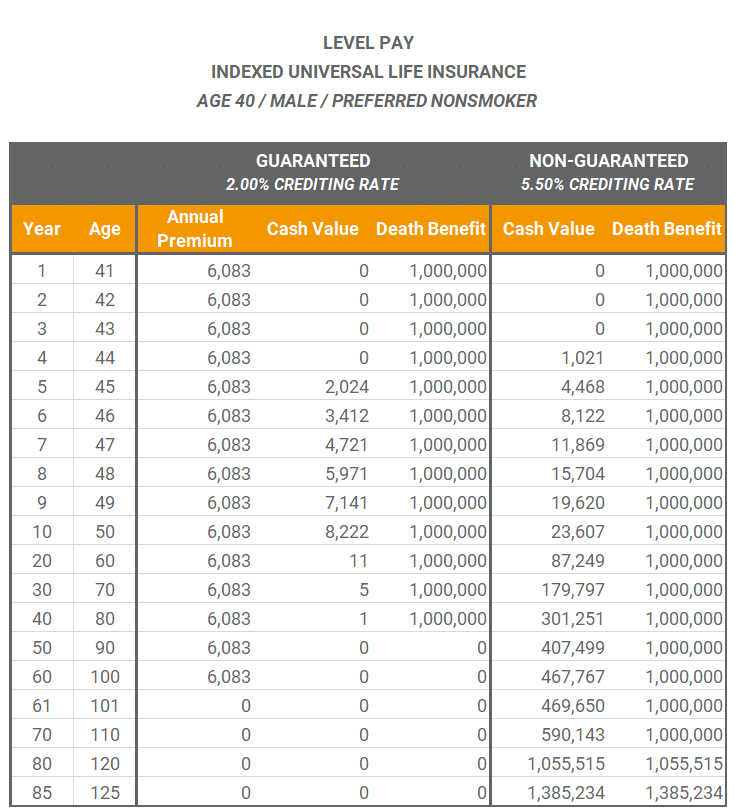

While some social media pundits suggest an IUL is a replacement product for a 401(k), it is not. Indexed Universal Life (IUL) is a type of permanent life insurance coverage policy that additionally supplies a cash worth part.

Latest Posts

529 Plan Vs Iul

Whole Life Vs Indexed Universal Life

Wrl Index Universal Life Insurance